No, you don't need an LLC to start selling on Amazon. You can create an Amazon seller account, start hunting for products, and sell without an LLC.

However, forming an LLC can be one of the best decisions you can make for your Amazon business, as it offers several advantages and protections that can benefit your business in the long run.

In this guide, we’ll answer the following questions:

- What Is an LLC?

- What Are the Benefits of Having an LLC for Your Amazon Business?

- What Is Better: LLC or Sole Proprietorship?

- What Are the Other Amazon Business Entity Type?

- When Should You Consider Filing an LLC for Your Amazon FBA Business?

- How to Form an LLC

- How Much Does It Cost To Set Up an LLC?

- Frequently Asked Questions

What Is an LLC?

An LLC (Limited Liability Company) is a business structure in the United States that protects the owner's personal assets when the business faces a lawsuit.

It's like a shield that separates your assets from your business liabilities. Just like how knights use shields to protect themselves in battle, an LLC protects your assets from any legal or financial trouble your business might face.

If your business is sued or can't pay its debts, your assets, such as your home, car, and personal savings, are safe. The LLC structure is a popular choice among entrepreneurs and small business owners because it provides liability protection benefits without the corporation's complexity and formalities.

What Are the Benefits of Having an LLC for Your Amazon Business?

Liability Protection

As mentioned, forming an LLC helps you separate your personal and business assets. The LLC itself is responsible for its own debts, obligations, and legal actions against it, rather than the owner.

This is especially important in e-commerce because the risk of legal action is always present as transactions and customer interactions occur online. By forming an LLC for your Amazon business, you can have peace of mind knowing that your personal assets are protected from any legal issues that may arise.

Tax Benefits

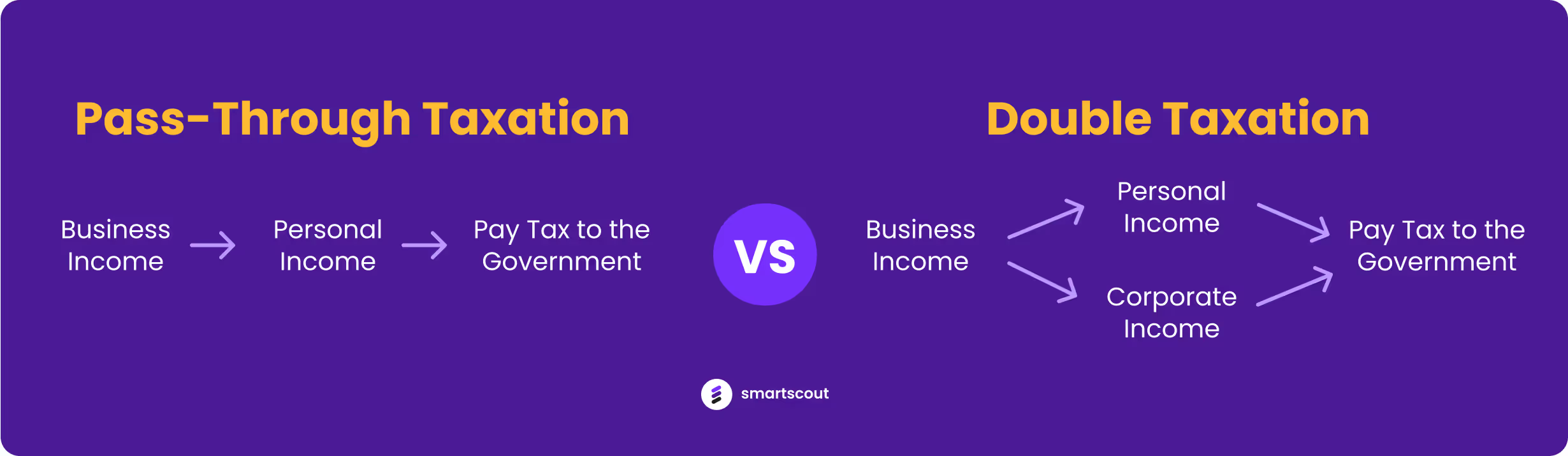

LLCs are pass-through entities, meaning the income it generates passes through to the owners and is reported on their personal tax returns.

Pass-through entities help you avoid double taxation. The business itself does not pay federal income taxes, and instead, the business income is only taxed once on the owner's personal income tax return.

LLCs are also more flexible in how they are taxed. They can be taxed as a sole proprietorship, partnership, S corporation, or C corporation, depending on what makes the most sense for their business.

For example, an Amazon seller who is just starting may prefer to be taxed as a sole proprietorship since it requires less paperwork and has fewer formalities than other structures.

As the business grows, the seller can choose to be taxed as an S corporation to minimize their tax liability. Alternatively, if the seller wants to raise capital by issuing stocks, they may choose to be taxed as a C corporation.

Having the ability to change their tax structure also allows Amazon sellers to adapt to changes in their business and take advantage of new tax opportunities.

Enhanced Credibility and Trust With Customers and Suppliers

Having an LLC for your Amazon business can also enhance your credibility and trust with customers and suppliers.

When they see that your business is a registered LLC, it can signal that you are serious about your business and have taken steps to protect yourself and your customers. In addition, most wholesale suppliers prefer to do business with LLCs because they perceive them as more professional and trustworthy.

What Is Better: LLC or Sole Proprietorship?

The two most common legal structures for small businesses in the United States are the sole proprietorship and the LLC (Limited Liability Company).

While both have pros and cons, the best choice for your business will depend on several factors, such as your business's nature, risk tolerance, and long-term goals. Understanding the differences between the two structures can help you make an informed decision and choose the one that best aligns with your business objectives.

What is a Sole Proprietorship?

A sole proprietorship is the simplest and most common form of business structure. It is essentially an extension of the individual owner and has no separate legal identity. The owner is responsible for all debts and legal actions against the business.

It is an attractive starting point for those who are just starting and want to test the waters before committing to a more formal business structure.

One advantage of a sole proprietorship over an LLC is its lower startup costs and fewer ongoing fees and maintenance requirements. This can be an excellent option for people with limited resources or for those who want to keep their overhead costs low in the early stages of their Amazon selling journey.

A Hypothetical Example

Let's say that John wants to start an online store on Amazon selling handcrafted jewelry. He decides to operate as a sole proprietorship and doesn't form an LLC. John started selling his products on Amazon and quickly gained a lot of customers.

However, after a few months, a customer buys a necklace from John's store that breaks soon after arrival. The customer is upset and decides to sue John for the cost of the necklace plus additional damages.

Since John operates as a sole proprietorship, he must pay for any legal fees or damages awarded to the customer out of his own pocket. If John had formed an LLC, his assets would be protected, and the LLC would be responsible for any legal action against it.

So, which is better: LLC or Sole Proprietorship?

- A sole proprietorship is the best option for someone just starting their business and with no significant personal assets or liability risks associated with their business activities. It may also be a good option for those who want to keep things simple and avoid the added expenses and administrative burdens of forming and maintaining an LLC.

- An LLC is the best option if you are concerned about potential lawsuits or debts associated with your business. If you have partners, an LLC can also provide a more structured and formal framework for managing the business and dividing profits and responsibilities. Plus, if you want to sell via the Amazon wholesale model, having an LLC can help suppliers see you as a credible and legitimate seller.

Other Amazon Business Entity Types

In addition to LLCs and sole proprietorships, there are other types of business entities that Amazon sellers can consider: the S Corps and C Corps.

S Corps:

S Corps are similar to LLCs in taxation but have additional benefits, such as limited liability protection and avoiding double taxation. This means the business income passes through to the individual shareholders' tax returns, and the corporation does not pay federal income taxes.

However, S Corps have stricter requirements, including a limit on the number of shareholders and restrictions on who can be a shareholder.

C Corps:

C Corps, on the other hand, are separate legal entities from their shareholders, which means they can raise capital by selling stocks. This structure offers the highest level of limited liability protection but comes with higher taxes and more regulations.

C Corps pay taxes on their profits, and shareholders also pay taxes on any dividends received.

When Should You Consider Filing an LLC for Your Amazon FBA Business?

Here are two of the many cases in which you should consider upgrading to an LLC:

When You’re Selling High-Risk Products.

If your Amazon business involves selling high-risk products, such as supplements or electronics, then it's recommended that you consider filing an LLC. These products have a higher likelihood of causing harm to customers, which means you could be at risk for lawsuits or liability claims.

Suppose you sell supplements on Amazon, and a customer suffers from an adverse reaction after consuming one of your products. Without an LLC, you could be personally liable for any damages or medical bills the customer incurs. This could put your personal finances and assets at risk.

However, if you have an LLC, only the business's assets are at risk, and your personal assets are protected.

When Your Amazon FBA Starts Making a Lot of Money.

As a business grows, the risks associated with it also increase.

For example, hiring employees exposes you to additional employee lawsuits or dispute risks. Similarly, if your business expands into new product lines or enters new markets, you may face new regulatory and compliance requirements.

LLC owners also have the option to elect to be taxed as an S Corporation, which can provide even more tax benefits. With an S Corporation, owners can take a portion of their income as a salary subject to payroll taxes. The remaining income is considered a distribution and is not subject to payroll taxes. This can lead to potential tax savings since payroll taxes are typically higher than income tax rates.

How to Form an LLC

The easiest way to set up an LLC is through a formation service.

The formation service will handle the paperwork and filings necessary to form your LLC. All you need to do is provide basic information about your business, and the service will take care of the rest. This can save you time and hassle and help ensure your LLC is set up correctly.

Best LLC Filing Services of 2023

- Best Overall: ZenBusiness

- Most Affordable: Incfile

- Best for Legal Services: Rocket Lawyer

- Best for Small Business: Northwest Registered Agent

- Best for Entrepreneurs: Hashtag Legal

- Best for Online Business: LegalZoom

- Best for Real Estate Investing: Inc Authority

- Best for Attorney Review: Nationwide Incorporators

The best LLC filing services of 2023, according to Investopedia

What if You’re Up for the Challenge and Want To Form LLC Yourself?

Here are the few steps to follow.

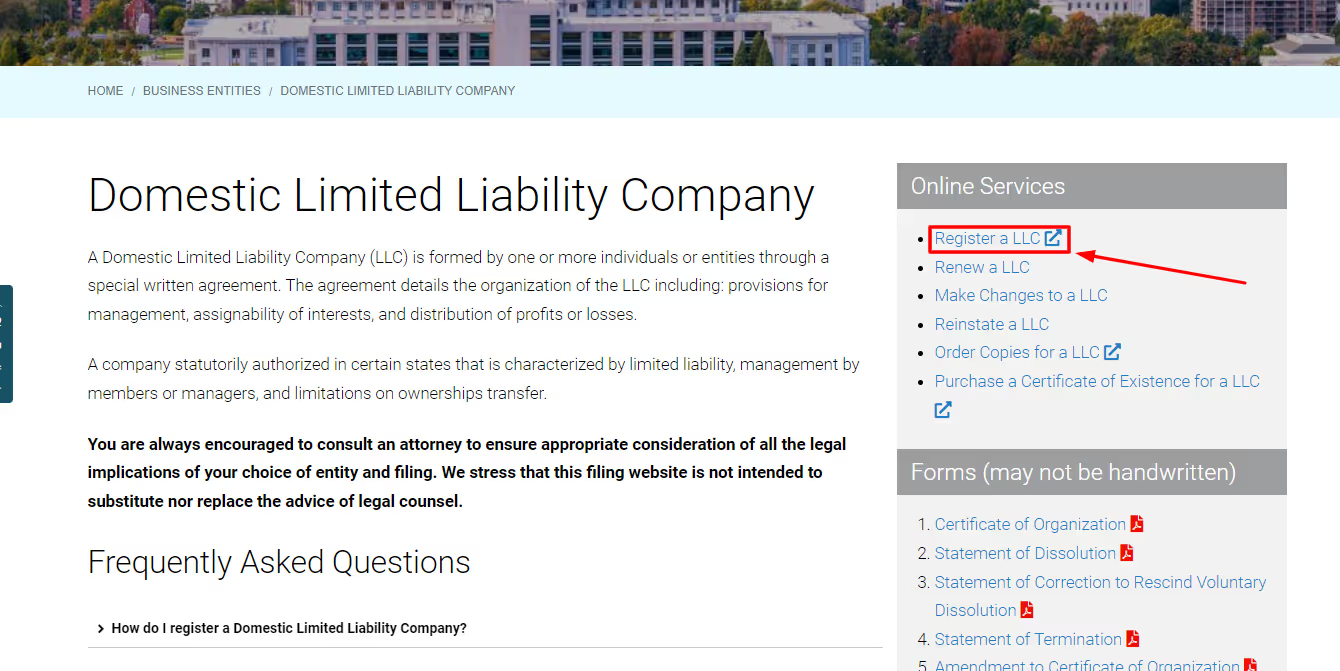

Step 1. Go to Your State’s Website

Each state has its own rules and regulations for forming an LLC, so visit your state's website. Look for the section on starting a business; you should find information on how to set up an LLC.

Search "[Insert state] LLC File" on Google and find your state's website.

For example, if you live in Utah, just type "Utah LLC file."

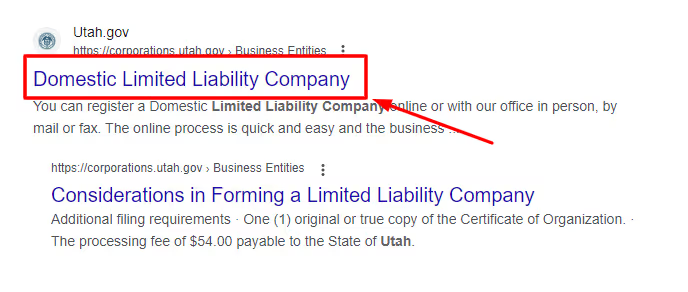

Then click on Utah’s state website.

From there, click on the "Register an LLC" link. You'll be asked to create an account, and then you can start setting up your LLC.

Step 2. Choose a Name for Your LLC

Your LLC name must be unique and not similar to any existing business name in your state. You can check the availability of your desired name through your state’s secretary of state website.

Step 3. File Articles of Organization

This is a legal document that establishes your LLC as a legal entity. You must file it with your state's secretary of state office and pay a filing fee. The articles of organization generally require the following information:

- Business Name

- Registered Agent's Name and Address

- Business Purpose

- Member Names

Step 4. Get an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique identifier for a business used for tax purposes, just as a Social Security Number (SSN) is a unique identifier for an individual used for tax purposes. In other words, it’s like a social security number for your business.

You will need an EIN to open a business bank account, file taxes, and hire employees. You can apply for an EIN online for free.

Step 5. Draft an operating agreement

An operating agreement outlines how your LLC will be managed and operated. Although it is not required by law, it is highly recommended as it clarifies member roles, responsibilities, and voting rights.

Step 6. Get the necessary licenses and permits

The necessary permits and licenses required to file for an LLC may vary depending on the type of business you operate and the state or local jurisdiction where your business is located. Some common permits and licenses that businesses may need to obtain include a business license, sales tax permit, zoning permit, health department permit, and professional license.

Step 7. Open a business bank account

Having a separate bank account for your business helps keep your personal and business finances separate, which is important for liability protection and tax purposes. It also helps with bookkeeping and record-keeping, as all business transactions can be easily tracked in one place.

How Much Does It Cost To Set Up an LLC?

The fees for setting up an LLC can depend on the state in which you are filing it. Generally, there are three fees to consider: filing fee, operating agreement, and cost of hiring a registered agent.

Filing Fee

There are two types of filing fees involved: the filing fee and the ongoing fee.

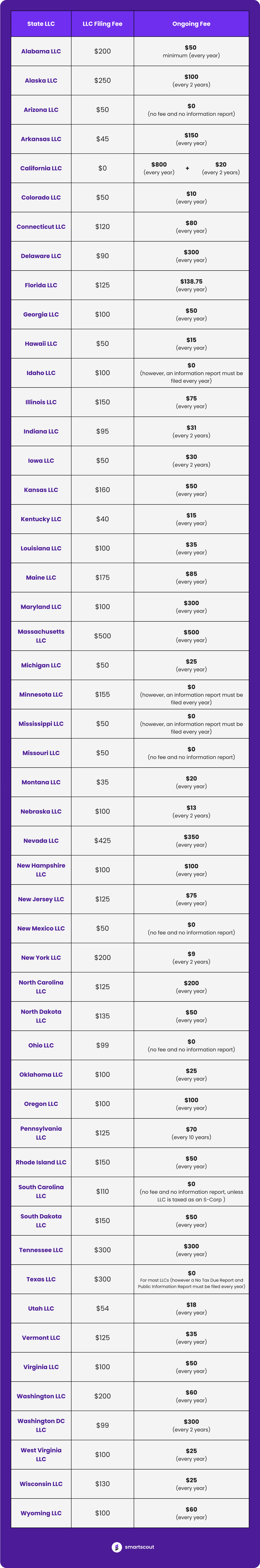

The filing fee is the fee you pay the state to file the necessary paperwork to form the LLC. Depending on the state, this fee can range from around $50 to $500.

The ongoing fee is paid yearly to keep your LLC in good standing. This fee can also vary from around $50 to $500, depending on the state.

Here’s a list of LLC fees for every U.S. state from LLC University:

Operating Agreement Fee

Creating an operating agreement can range from $0 if you make one yourself up to several hundred dollars if you hire a lawyer or an online legal service to do it for you.

Registered Agent Fee

A registered agent is a person or a company that accepts legal documents and official government correspondence on behalf of your LLC. Most states require LLCs to have a registered agent, which can be an individual or a professional service. The cost of a registered agent can vary depending on the service provider and the location. Generally, registered agent services can range from around $50 to $500 annually.

Conclusion

Forming an LLC can be one of the most powerful tools you can wield for your Amazon selling business. Not only does it help shield your personal assets, but it also boosts your credibility. Having an LLC shows you are serious about your business and willing to invest in its growth.

This can help build trust with customers, suppliers, and potential investors. Plus, the flexibility in taxation can save you money and make it easier to manage your finances. While it may require some upfront investment, the long-term benefits outweigh the costs.