Tired of waiting for Amazon payouts? Instant payment options are transforming how sellers manage their cash flow, allowing them to access funds for invoices and reinvest in their businesses faster than ever before. But with various choices available, each with its own trade-offs, how do you find the right fit for your needs?

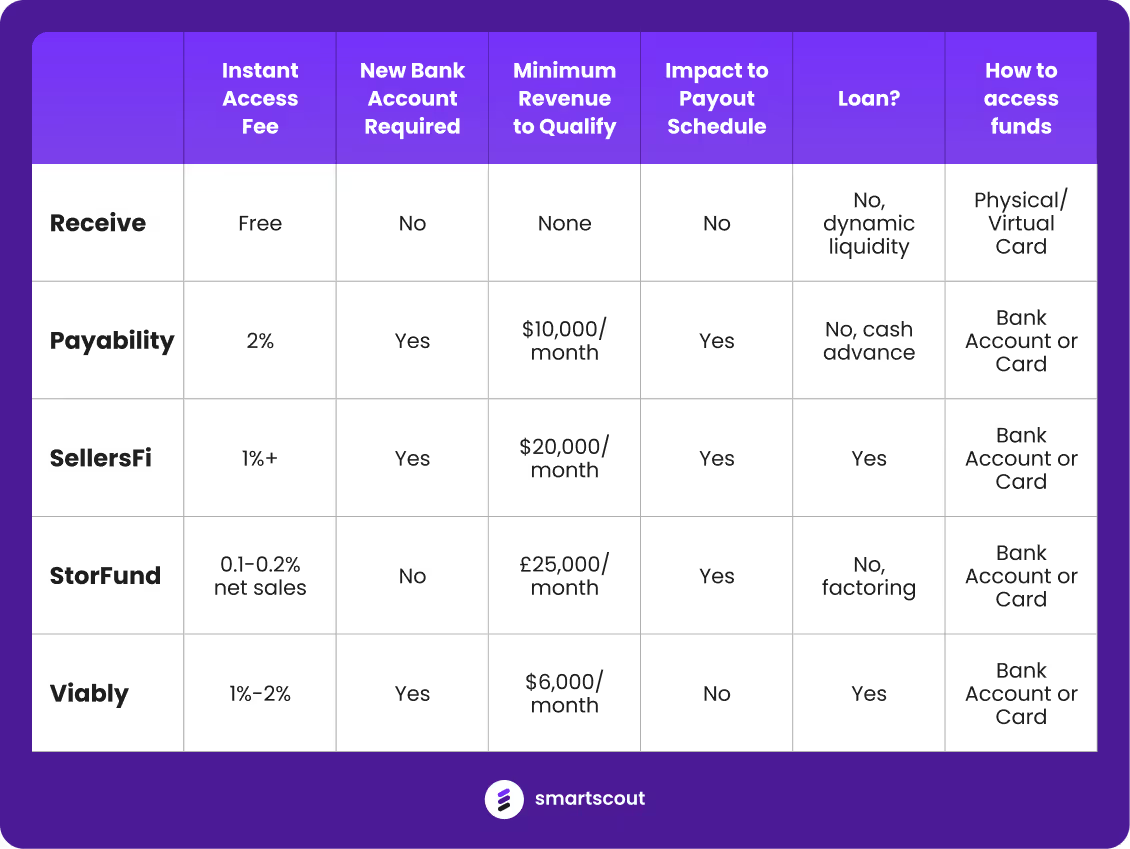

The chart below compares the top instant payment options for Amazon sellers, highlighting key features and considerations to help you make an informed decision. Whether you prioritize speed, fees, or specific requirements, understanding these solutions is crucial for optimizing your financial strategy and fueling your business growth.

Receive

Receive eliminates disbursement delays by providing Amazon sellers instant access to sales revenue anytime, anywhere. Simply connect your Amazon Seller account and bank account to access dynamic spending power based on recent sales quickly. Use your Receive virtual or physical cards to manage cash flow, invest in advertisements, and purchase inventory. By eliminating credit score impact, interest, or fees, managing cash flow and funding your business growth has never been easier.

Receive uses dynamic liquidity, meaning a seller's spending power fluctuates based on incoming receivables and bank account balance.

To sign up, schedule an appointment today.

Payability

Payability offers a compelling instant payment solution for Amazon sellers, enabling them to access their earnings more quickly than the standard payout schedule Amazon provides.

This service is especially beneficial for sellers who need to reinvest in inventory or cover operational costs without waiting for the usual payout period. Importantly, Payability's offering is not a loan but rather an advance on the seller's own earnings, providing a cash flow boost without the complexities or obligations of traditional financing.

To utilize Payability's services, sellers are required to set up a Payability bank account. This account isn't just for receiving funds; it also offers the flexibility to pay suppliers directly, which can streamline operations and financial management for sellers. The cost of using Payability starts at a fee of 2%, which is a consideration for sellers evaluating the service's value against their cash flow needs.

However, the fee structure is designed to be more favorable for sellers with higher sales volumes on Amazon, incentivizing larger sellers to use the service by offering them reduced rates. This tiered fee system means that the more a seller transacts on Amazon, the better the rates they can secure with Payability, making it an attractive option for high-volume sellers looking to optimize their cash flow and financial operations.

SellersFi

SellersFi is another innovative instant payment solution tailored for Amazon sellers, providing them with a unique financial tool to access their earnings swiftly. Unlike Payability, SellersFi's service starts at a lower fee of 1%, but it's important to note that this attractive rate is contingent upon the seller achieving a certain revenue threshold, making it an option more suited for higher-earning Amazon businesses.

A key distinction with SellersFi is that its financial product is classified as a loan. This classification has several implications for sellers considering SellersFi. Firstly, because it's a loan, there's an inherent impact on the seller's payment schedule with Amazon. Instead of simply advancing payments, SellersFi's approach alters the cash flow dynamics, as repayments need to be planned and managed within the seller's financial operations.

The fact that SellersFi's offering is considered a loan also means that there could be credit implications for the seller. This aspect necessitates a careful assessment from the seller's side, weighing the benefits of immediate cash flow against the responsibilities and potential impacts of taking on a loan.

In essence, SellersFi provides a potent tool for Amazon sellers with substantial sales, offering them the liquidity needed to maintain and grow their operations. However, the loan nature of SellersFi's service and the revenue requirements mean that it's essential for sellers to thoroughly evaluate their business's financial health and growth trajectory before opting for this solution.

Storfund

Storfund stands out as an instant cash solution for Amazon sellers, offering a distinctive approach to managing cash flow by providing quick access to earnings.

What sets Storfund apart in the competitive landscape of financial solutions for e-commerce is its fee structure, which is notably low, ranging around 0.1% to 0.2% of the net revenue. This pricing model makes Storfund an attractive option for Amazon sellers of various sizes, seeking to enhance their liquidity without significant costs.

Unlike some other financial services, Storfund does not require sellers to open a specific bank account, simplifying the process and allowing for more direct integration with the seller's existing financial setup. The mechanism behind Storfund's offering is factoring, a financial transaction where a business sells its accounts receivable (in this case, the future Amazon payouts) to a third party (Storfund) at a discount. This method provides the seller with immediate capital, which is crucial for maintaining inventory, marketing, or covering other operational expenses.

However, as with any financial service, it's important for sellers to understand that while Storfund provides quick access to capital, it is essentially a form of loan, where the future receivables are advanced at a cost, albeit a relatively low one in Storfund's case.

Viably

Viably emerges as another financial service catering to the needs of Amazon sellers, providing them with a robust option for managing their cash flow.

Unlike the more straightforward instant payment solutions, Viably is primarily recognized for its loan services but also offers instant advances to Amazon sellers. This dual approach enables sellers to choose the financial product that best suits their immediate and long-term business requirements.

One of the key advantages of using Viably's instant advance service is that it does not affect the seller's payout schedule with Amazon. This feature is particularly beneficial as it allows sellers to access the capital they need without disrupting their regular income stream from Amazon sales.

However, it's important to note that Viably requires sellers to open a specific bank account to use their services. This requirement is a part of Viably's operational framework, ensuring a seamless flow of funds and enabling efficient management of the advances and loans provided. While the necessity of a separate bank account might be seen as an additional step for sellers, the benefit of having immediate access to funds, coupled with the unaffected payout schedule, presents a compelling value proposition for Amazon sellers looking to optimize their financial operations without compromising their standard revenue inflow.