You’ve built your eCommerce business to over $1 million in annual sales. You’ve experienced the joys of growing a business, connecting with other million-dollar sellers, and learning valuable growth lessons. But now you’re up for a new challenge. You’re exploring new directions.

So, it’s exit time.

However, you know that selling a business is no walk in the park. Finding a buyer who will pay a fair price and maintain your brand’s positive reputation post-exit is a tough nut to crack.

Well, that’s until Amazon aggregators such as Thrasio and Perch came to market. These aggregators are great on their own. Thrasio has raised over $2 billion, and Perch has raised nearly $1 billion.

But you can’t sell to the two of them. You must choose one buyer.

Enter this review: We’ll explore Thrasio and Perch to help you choose the best exit enabler for your business.

What is Thrasio?

Thrasio is an Amazon aggregator with over 200 brands in its portfolio.

The company’s mission is to make the world's most-loved products accessible to all. As a result, it targets six-figure Fulfillment By Amazon (FBA) sellers—offering them a seamless and profitable exit—to transform the business into a world-leading brand.

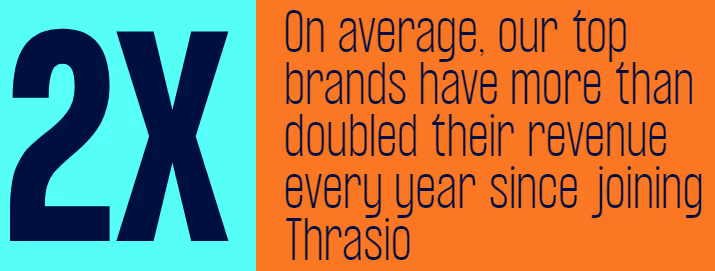

And Thrasio seems to be successful at that. For instance, data show that the company’s top brands double their revenue every year after joining the aggregator and about 86 percent of their FBA businesses sell internationally.

Also, Thrasio’s products are available in more than 150 retail outlets and marketplaces. The company estimates that one in six US households has purchased its products.

What is Perch?

Perch is an Amazon aggregator with over 100 brands under management.

It aims to acquire profitable FBA businesses and help them reach new heights. In addition, the company promises to bring tech-enabled sophistication to the brand it acquires to scale them on Amazon and beyond.

The company’s founders and current CEO, Chris Bell, a seasoned eCommerce operator with experience at GE, Wayfair, and Bain & Company, said that Perch is not just a roll-up but a tech-first platform that adds value to the brand it acquires from day one.

The aggregator acquires only businesses with at least $1 million in revenue or $200,000 in profit and those that do 70% to 100% of their sales via Amazon. It also buys from any category, excluding weapons or CBD-related categories.

Perch also considers international sellers, especially those in the EU, UK, and Canada.

Financials

What’s Thrasio and Perch’s worth, and how much have they raised since their founding?

Thrasio

Thrasio’s current valuation is around $6 billion, making it the biggest Amazon aggregator today.

Thrasio reported a $500 million revenue within two years, doubling its revenue every 73 days on average. In addition, data from Crunchbase show that the company raised nearly $400 million within 15 months to become a unicorn, setting a record as the fastest profitable brand to achieve the status.

And since April 2019, the aggregator has raised about $3.4 billion in ten funding rounds, including a $500 million debt facility it received in the sixth funding round to increase the company’s balance sheet without diluting ownership.

Thrasio’s latest financing was a $1-billion-Series D-funding it received in October 2021, a month after it raised a $650 million debt financing facility, which puts its total funding at nearly 50 percent of all the venture funds Amazon aggregators got in 2021.

Perch

Perch has raised over $900 million in four funding rounds backed by seven investors.

The company raised $10.3 million in two separate seed funding rounds between December 2019 and April 2020. Six months later, the Amazon aggregator raised $125.5 million during its third funding round, backed by four investors.

Perch has been profitable since its founding, so the CEO announced that the cash flow would go into “acquiring additional winning brands and products” and building the team.

In May 2021, Perch raised $775 million in its fourth funding round, the largest Series A landed by a consumer packaged goods company, garnering four times more than the previous holder—an impressive record for an 18-month-old startup.

Verdict

Both companies have been profitable since their inception. However, Perch secured the largest Series A funding ever. Thrasio raised about $2.6 billion more than Perch’s $0.9 billion total funding, making it the clear winner in this category.

Exit Process

How seamless are Thrasio and Perch’s FBA business acquisition process?

Thrasio

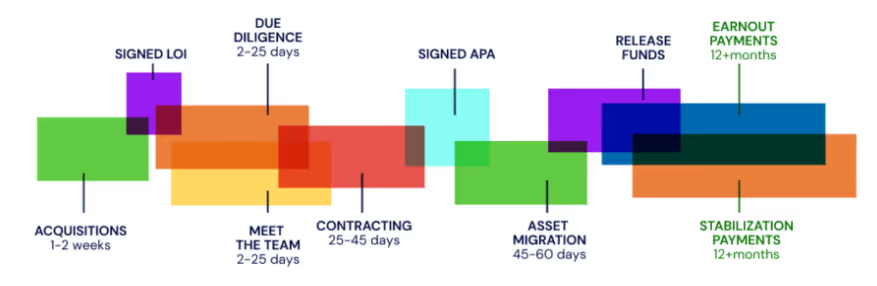

Thrasio’s exit process is straightforward.

Amazon merchants willing to sell their FBA business can contact the brand through email, and a representative from the company will get in touch within 24 hours. Next, Thrasio works with the seller to see if the business fits their profile. If it's what they are looking for, the brand will work with the seller to structure a deal that works for both parties.

Although the company says it offers customized treatment for each deal, its acquisition and exit process is the same and might last up to 60 days.

For instance, the first contact to prepare the contract and sign the agreement might take 25 to 45 days. Asset migration and funds release usually start from the 45th day and might run up to 60th days.

Perch

Perch’s exit process takes about five simple steps.

The steps begin with a review that lasts up to three days after an interested seller submits the storefront and rough financial estimate. Next, Perch’s team will set up a call if there’s a fit. Then, they’ll set up a series of follow-ups for a more in-depth review.

If Perch decides to acquire the business, the team will share a Letter of Intent (LoI) within the seventh day, detailing its offer and growth plan for the business. Next, the aggregator will perform due diligence between the 15th and 75th day to verify all the details and work towards the final purchase agreement.

Signing the final agreement and migrating the brand into Perch’s system happens between the 30th and 90th day. However, the company can complete an acquisition in less time, even as quickly as three weeks.

Verdict

Thrasio and Perch’s acquisition processes are both seamless. So, they are both winners in this category.

Brand Growth Strategy

How do Thrasio and Perch grow the FBA businesses they acquire?

Thrasio

Thrasio adopts a five-step process to transform brands it acquired into household names.

After closing a deal with the seller, the brand puts the business through a rigorous 500+ checkpoint process to develop an actionable, custom plan to boost its growth. Also, it deploys its team of eCommerce experts with experience improving tens of thousands of products to grow and scale the business.

The team optimizes the products on Amazon and works with other relevant stakeholders to transform it into a “5-star force.” Additionally, it explores other distribution channels to expand the brand beyond Amazon to maximize its growth potential.

Perch

Perch’s growth playbook provides actionable plans for growing its brands.

The aggregator subjects newly acquired FBA businesses through a checklist of SEO best practices to see how they stack up against other competitors. It also develops a merchandising roadmap, optimize the pricing and invest in PPC campaigns to drive off-Amazon traffic to the products, reaching new audiences.

Perch leverages the experience of its over 250 Amazon experts to scale the business and push it beyond its potential. In addition, it explores additional marketing channels such as email and affiliate programs to push the product further.

Besides marketing, Perch also invests in product innovation and supply chain efficiency.

Verdict

Both Thrasio and Perch have solid growth roadmaps for the brands they acquire. But it seems Perch brings more to the table, so I'll give them this category with a little hesitation.

Pros

What are the advantages of selling to Thrasio and Perch? Let’s find out.

Thrasio

Thrasio offers several advantages for sellers, including these:

- Thrasio offers sellers a seamless exit, giving them a clean break from the business.

- The aggregator gives sellers huge cash payouts and earnouts if the business continues to make substantial annual sales.

- Selling to Thrasio means FBA merchants don’t have to worry about handling inventory, dealing with returns, or overseeing sales promotions.

- Thrasio's solid growth roadmap can transform any FBA business into a household name.

- The aggregator offers seller consulting contracts, enabling them to remain a part of their business and benefit from it.

- Thrasio has a lot of cash to invest in improving the business.

Perch

Selling to Perch also comes with several benefits, and here’s a rundown:

- Perch, like Thrasio, offers FBA merchants a profitable exit from their business.

- The aggregator relieves sellers of the stress of running their business, enabling them to focus on their passion.

- Perch has an actionable playbook for growing the brands they acquired, and they can scale them beyond their geographical location to shine as a consumer goods brand.

- Perch can buy from any category, of course, except those that deal in weapons and CBD-related products.

- Perch’s affiliate program can help the brand get featured in the best publications.

Verdict

Both Thrasio and Perch pack some punch.

However, I'll give this category to Thrasio. The aggregator offers earnouts and consulting contracts that help sellers remain closer to their brand while still profiting from it. Also, Thrasio has a larger cash flow to invest in improving the brands it acquires.

Cons

What are the disadvantages of selling to Thrasio or Perch?

Thrasio

Selling to Thrasio doesn’t pose any significant risk other than merchants who might experience seller’s remorse for a business they spent a significant part of their lives building.

Perch

Besides seller’s remorse, other disadvantages of selling to Perch are:

- The seller shouldn't expect earnout pays.

- Perch doesn't offer sellers the opportunity to be part of their brand again through contract agreements.

- Perch has a limited financial chest compared to Thrasio.

Verdict

Selling to Thrasio and Perch is not all pleasant, but the disadvantage is less with Thrasio than Perch. So, Thrasio wins this category.

Similarities

What do Thrasio and Perch share in common?

- Thrasio and Perch offer a profitable exit from their FBA businesses.

- The companies have raised considerable funds from investors to become the leading aggregators in the market today.

- Thrasio and Perch acquire only top Amazon brands.

- Both brands have impressive growth plans for the FBA businesses they acquire.

- It takes approximately the same number of days to complete an exit process.

- Thrasio and Perch have a similar mission to acquire top Amazon sellers and help them reach new heights.

- Some of their acquisitions have grown to be household consumer goods brands.

Payment

How much do Thrasio and Perch offer sellers to acquire their businesses?

Thrasio

Thrasio has paid over $150 million since it started FBA businesses.

It offers sellers 2.5 to 4.5 times their annual sales in one payment, big enough to convince most FBA merchants to part ways with their brand.

Additionally, the aggregator offers stabilization payment if the business maintains its pre-acquisition sales volume for 12 months. Thrasio also gives earnout to sellers whose brand grew under its portfolio. The company claims that a typical earnout increases a seller’s total payout by 37 percent.

Perch

Perch doesn’t share its payment structure like Thrasio publicly.

However, if the interview by Catherine Seifert, one of the FBA merchants Thrasio and Perch approved for a deal, is anything to go by, both companies offer the same payment.

She said that “the money up front was the same” but took Thrasio’s deal because they offer an “astronomical” payout for future growth — probably the stabilization and earnout payments.

Verdict

Thrasio and Perch offer sellers similar deals. But the former stands out with its stabilization and earnout payments, making Thrasio a clear winner in this category.

Final Verdict: Thrasio Vs. Perch

Thrasio and Perch are two leading Amazon aggregators today.

Both companies have raised considerable funds from investors to ramp up capacity to acquire top-selling Amazon brands, offering the sellers a seamless and profitable exit to scale the business beyond Amazon and make them household consumer brands.

However, unlike Perch, Thrasio offers sellers stabilization and earnout payments, making the total payout package more lucrative. The aggregator also gives sellers consulting roles to quickly transition and help whenever problems arise.

So, Thrasio is the ultimate winner here.