You don’t need to care about laundry to learn from this.

Because what’s happening right now in Amazon’s liquid detergent category is basically a perfect case study in modern brand warfare — and it’s playing out in one of the most boring-sounding but brutally competitive spaces online.

The detergent aisle may seem like the last place for disruption, but under the surface, this category is full of everything we see in today's e-commerce battles:

- Household giants defending their turf

- Niche challengers sneaking in with DTC-style playbooks

- Legacy brands getting outpaced by "nobody" newcomers

- Natural players fighting for ethical and ingredient-conscious customers

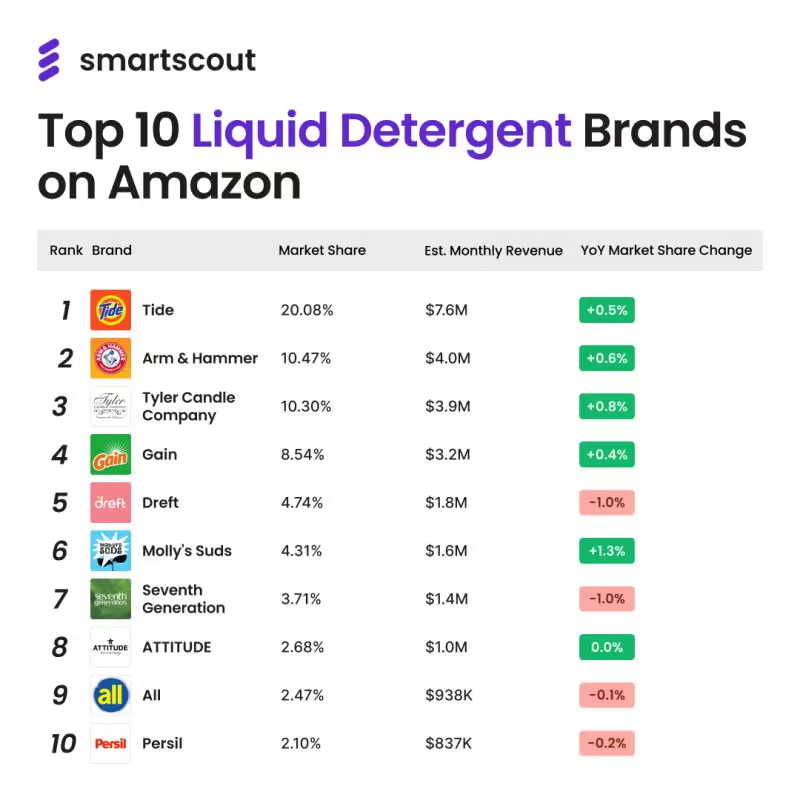

The Top 10 Liquid Detergent Brands on Amazon (Estimated Monthly Revenue)

- Tide — $7.6M

- Arm & Hammer — $4.0M

- Tyler Candle Company — $3.9M

- Gain — $3.2M

- Dreft — $1.8M

- Molly’s Suds — $1.6M

- Seventh Generation — $1.4M

- ATTITUDE — $1.0M

- All — $938K

- Persil — $837K

What’s Really Happening Here?

Household Giants Are Still Standing—But Vulnerable

Tide, Arm & Hammer, and Gain continue to dominate in total revenue, thanks to massive brand equity, shelf presence, and decades of consumer trust. But these positions are no longer guaranteed as Amazon levels the playing field for upstart challengers.

The Tyler Candle Company Crossover Play

Third on the list is Tyler Candle Company, pulling in nearly $4M per month — despite the fact that they didn’t even start in detergent. Their fragrance-forward approach (rooted in their candle business) created a unique crossover appeal, proving that strong brand identity can translate across categories.

Molly’s Suds: The Smart Natural Challenger

Molly’s Suds, a natural brand, is the biggest year-over-year gainer in the category (+1.3%). They’ve built trust through ingredient transparency, a focused mission, and smart DTC-style marketing. This shows that consumers are willing to move away from legacy brands if the story resonates.

The "Green" Messaging Isn’t Enough Anymore

Even brands like Dreft (targeting baby-safe) and Seventh Generation (pioneers in natural cleaning) are losing momentum, both down -1.0% YoY. Their early ethical positioning is no longer a unique selling point — visibility, pricing, and storytelling still matter even if your product is "clean."

The Big Takeaway: This Isn’t Just About Detergent

What we’re seeing here applies across nearly every category on Amazon (and e-commerce in general). The rules of modern brand building look like this:

- Relevance beats legacy.

Even the biggest names can lose share if they don’t stay culturally relevant.

- Emotion beats function.

People aren’t buying detergent; they’re buying peace of mind, status, ethics, or a sense of identity.

- Performance + Story wins.

You need both a great product and a strong, distinctive narrative.

Why This Matters for Every Brand

You can be a small, outsider brand and still win—if you understand today’s consumer behavior:

- Identity > function

- Story > price

- Trust > ubiquity

The detergent fight is just a microcosm. The same dynamics are playing out in sunglasses, snacks, supplements, software — you name it.